The Income Tax Act,1961 provides for a deduction for interest paid on Loan taken for educational Loan for Higher Studies under section 80E. Since Higher Studies are very expensive , this section aims to reduce the burden on the taxpayer by providing a deduction from his Taxable Income. Eligibility:- Only an individual Taxpayer can claim […]

Tag Archives: CA in Pune

Tax Audit under section 44AB of Income Tax Act,1961 Meaning of Tax Audit :- An audit means the verification of books of accounts by an independent auditor and expressing an opinion on the financial statements drawn with respect to those books of accounts. Several statutes provide for the audit of books of accounts. […]

Input tax credit (ITC) can be understood as a deduction on total GST payable by the businessman. ITC is availed by the businessman by paying GST on the purchases and other expenses incurred for the business, Thus while paying GST the ITC already paid in the course of Purchase and other expense is deducted and […]

Introduction:- India is a developing economy. The speed of business is increasing day by day. As a result of this the volume of transactions is increasing at an equal speed. But along with these growth sectors there runs a parallel economy of corruption and money laundering. These sectors hinder the growth of the economy as […]

There has been a rise in the number of Startups Registration thanks to the attractive tax holidays provided by the Government in the past few years. However, Startups registered as Private limited Companies have a lot of compliance burden. Following is the list of most of the Compliances which a Start-up is needed to follow, […]

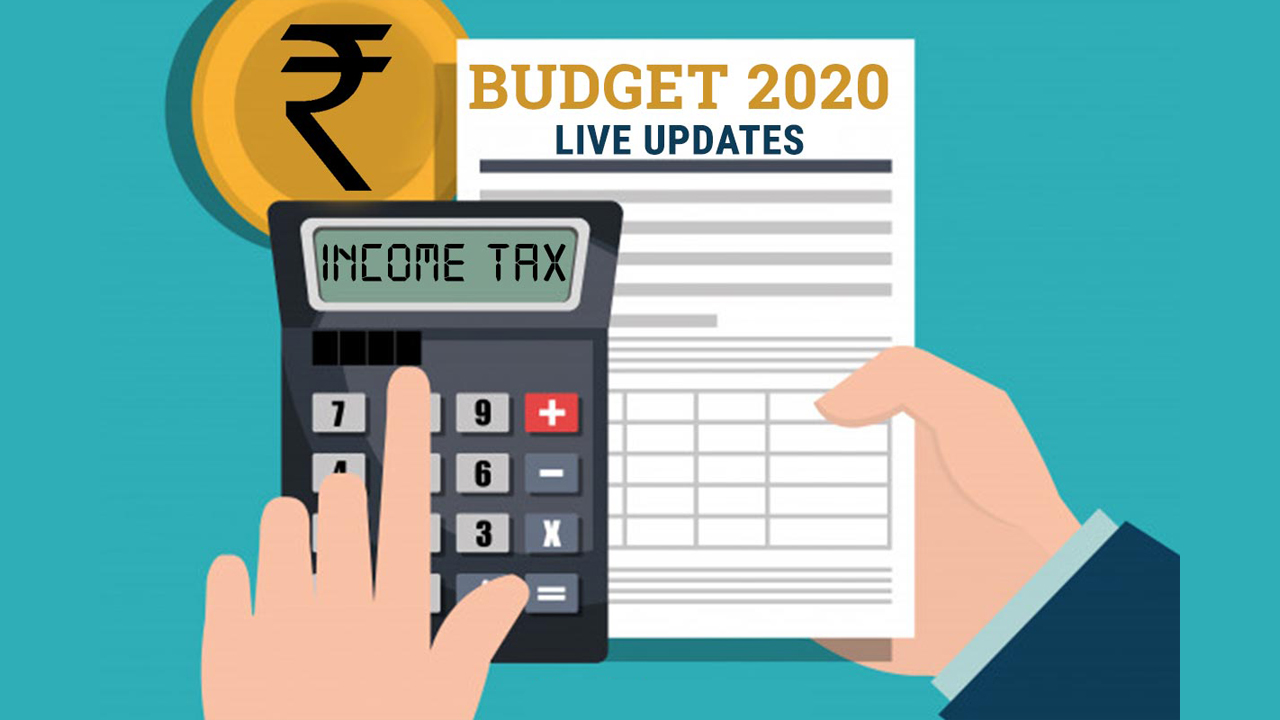

Direct Tax Simplified and New Income Tax Regime as an option to the old regime the old regime. Income Bracket (INR lakh) Tax Rate (per cent) Below INR 5,00,000 5,00,000 – 7,50,000 Exempt 10% 7,50,000 – 10,00,000 15% 10,00,000 – 12,50,000 20% 12,50,000 – 15,00,000 Above 15,00,000 25% 30% In the new tax regime, substantial […]

Funds are the most important part for running a business. The Companies borrow funds from various sources like Banks, Financial Institutions, other Body Corporate Members, Director or Stake Holders etc. These funds are further classified into two parts viz Owned Capital and Borrowed capital or Borrowings. Owned capital comprises of funds collected by issuing shares […]

Introduction Form GSTR 9 in an annual return under GST regime that is to be filed once for every financial year by every registered Taxpayer. GSTR 9 is a consolidation of every quarterly/monthly returns filed during the financial year. The taxpayers are required to furnish details regarding inward and outward supplies made and Input Tax […]